Posted on February 18, 2019.

Text : Kenneth Fong

So you’ve done the math, figured that you can afford the monthly cost of a car comfortably, and paid the downpayment for your brand new ride.

Congratulations!

Now comes the next cheem part: car insurance. Ugh.

And like all other forms of insurance, buying a car insurance policy can be a lengthy, complex, and downright expensive undertaking. Especially if you’re not discerning enough to pick out the right one for your needs.

So you’ve done the math, figured that you can afford the monthly cost of a car comfortably, and paid the downpayment for your brand new ride.

Congratulations!

Now comes the next cheem part: car insurance. Ugh.

And like all other forms of insurance, buying a car insurance policy can be a lengthy, complex, and downright expensive undertaking. Especially if you’re not discerning enough to pick out the right one for your needs.

We also have a car insurance review section where real users, like you, can leave their comments with regard to the various car insurers in Singapore. Be sure to check it out!

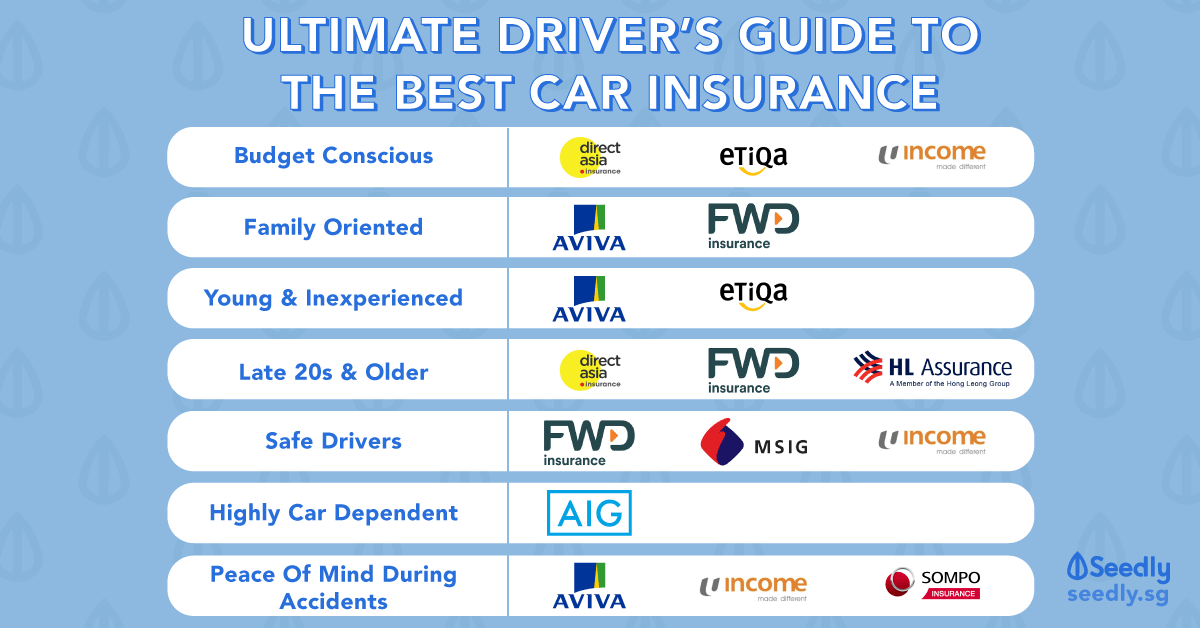

TL;DR: Which Is The Car Insurance For Me?

| Good For | Insurer |

|---|---|

| Budget-Conscious | DirectAsia, Etiqa, NTUC |

| Family-Oriented | Aviva, FWD |

| Young & Inexperienced Drivers | Aviva, Etiqa |

| Late 20s & Older | DirectAsia, FWD, HL Assurance |

| Safe Drivers | FWD, MSIG, NTUC |

| Highly Dependent On Car | AIG |

| Peace Of Mind During Accidents | Aviva, NTUC, Sompo |

How To Choose The Best Car Insurance In Singapore

This guide contains:

- A comparison of comprehensive car insurance plans only

- Optional benefits and add-ons are not included in the comparison

- However, special features which deserve a shoutout will be highlighted

Disclaimer: We’re going to give recommendations to the best of our ability and knowledge. But it’s best that you do your homework or talk to the various insurers to get a better idea of what you’re buying before you commit to any plan.

Don’t see a particular insurer? Don’t worry! Just bookmark this article first. We’re constantly updating it as we go!

AIG Car Insurance

Here’s a look at AIG’s comprehensive car insurance plans.

| AutoValue | AutoPlan | AutoPlus | |

|---|---|---|---|

| Workshop | Authorised | Any | Dealer’s workshop for cars (< 3 years old) If not, Authorised |

| Replacement Car | – | Yes (cars up to 3 years old) | Yes (cars up to 3 years old) |

| Excess Waiver | – | – | $1,000 for 50% NCD $500 for <50% NCD |

| Perks | – | – | Unlimited use of courtesy car Roadside assistance (eg. tyre change) |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

Cars up to 3 years old | Cars up to 3 years old Your car is your life |

Highlights

- Free NCD Protector on your 50% No Claim Discount (NCD) when you renew, for AutoPlan and AutoPlus

- Unlimited use of AIG’s courtesy car for AutoPlus

Our Recommendations

- Not for the budget-conscious due to the many benefits packaged

- Go for the AutoPlan or AutoPlus to get the most out of your money

- Good if you have a new car (3 years old or newer)

- Great option if you are highly dependent on your car for daily use (eg. sending your kids to school) or livelihood (eg. insurance agents)

Aviva Car Insurance

Aviva offers 3 types of comprehensive car insurance plans.

| Lite | Standard | Prestige | |

|---|---|---|---|

| Workshop | Authorised | Authorised Pay double excess for non-authorised |

Dealer’s workshop for cars (< 3 years old) If not, Authorised |

| Replacement Car | Yes (cars up to 1 year old) | Yes (cars up to 1 year old) | Yes (cars up to 2 years old) |

| Young & Inexperienced Driver (<24 years old or license <2 years old) Excess | $2,500 | $2,500 | Waived |

| Perks | – | – | Car crash detector Auto eCall assistance |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

Same as Lite | New premium cars Families with young drivers |

Highlights

- Lowest NCD penalty (10%) instead of the usual 30% applied by other insurers – meaning you can potentially skip NCD protection

- Preferential rates for drivers with policies signed since NS

- Prestige comes with a Bosch car crash detector + eCall assistance (automatically calls for help)

- Dual year plan option saves you an additional 5% on your premium

- One of the youngest limit for young & inexperienced driver excess (24 years old)

Our Recommendations

- Opt for Lite if you’re a young & inexperienced driver

- Opt for Prestige if you:

- Just bought a new car

- Have kids who just got their driving license

- Have bad dreams that your kids will get into a freak accident and somehow manage to flip the car over

AXA Car Insurance

There are a total of 7 AXA car insurance plans which can be broadly split into 2 types: SmartDrive Essential (limited to AXA authorised workshops only) and SmartDrive Flexi (any workshop).

| SmartDrive Essential | SmartDrive Essential+ | SmartDrive Peace | SmartDrive For Her | SmartDrive Flexi | SmartDrive Flexi+ | SmartDrive Flexi Family | |

|---|---|---|---|---|---|---|---|

| Workshop | Authorised | Authorised | Authorised | Authorised | Any | Any | Any |

| Replacement Car | – | – | – | – | – | – | – |

| Young & Inexperienced Driver (<27 years old) Excess | $2,500 ($5,000 for own workshop) | $2,500 ($5,000 for own workshop) | $2,500 ($5,000 for own workshop) | $2,500 ($5,000 for own workshop) | $2,500 ($5,000 for own workshop) | $2,500 ($5,000 for own workshop) | Waived |

| Perks | – | Transport allowance 110% of car’s market value insured |

Loss of personal effects | Transport allowance Phone assistance & roadside support |

– | Transport allowance 110% of car’s market value insured |

Loss of personal effects |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports Drivers on budget |

More expensive second hand cars Parallel imports Highly dependent on car |

Same as Essential+ | For younger female drivers who need more assistance | New cars under warranty Drivers on budget |

New cars Highly dependent on car |

New cars under warranty Drivers with kids who just got their license |

Our Recommendations

- Choose SmartDrive Essential plans if you own a car that is no longer under warranty – can claim as long as you go to an authorised workshop.

- Conversely, SmartDrive Flexi plans are best for new cars that are still under warranty.

DirectAsia Car Insurance

DirectAsia has a wide range of car insurance plans to fit almost any driver, requirement, and age. Here’re the core plans you’ll start with:

| Comprehensive | SOS | |

|---|---|---|

| Workshop | Authorised | Authorised |

| Replacement Car | Yes (cars up to 2 years old) | – |

| Young & Inexperienced Driver (<30 years old or license <2 years old) Excess | Not imposed but must be listed as Named Driver | Not applicable |

| Perks | – | A second chance for comprehensive coverage despite your history of accidents |

| Best for | Seasoned drivers >30 years old |

Drivers who can’t get insured elsewhere |

Once done, you can choose from 3 flexible Driver Plans or add any optional benefits to your heart’s content.

Highlights

- All plans come with a Lifetime Repair Warranty at DirectAsia authorised workshops

- If you’ve held 50% NCD for the last 5 consecutive years, you qualify for the DirectAsia exclusive NCD60 and get an extra 10% discount off your base premium

- SOS car insurance (a DirectAsia-only offer) if within the last 3 years, you or any of your drivers had 2 or more at fault accidents OR had your/their insurance refused or terminated

Our Recommendations

- Choosing a DirectAsia car insurance plan means cheaper premiums as you’ll only be opting-in for the features you want

- The NCD60 discount is a no-brainer for safe drivers, it’s also an immediate benefit unlike ‘for life’ NCD schemes where you will only see the benefit in the unfortunate event that you have to make a claim.

Etiqa Car Insurance

Etiqa keeps it simple with only one plan.

| Comprehensive | |

|---|---|

| Workshop | Authorised |

| Replacement Car | – |

| Young, Elderly or Inexperienced Driver (<24 years old, >75 years old, or license <2 years old) Excess | $4,000 |

| Perks | Transport allowance |

| Best For | Older cars Second hand cars Parallel imports Seasoned drivers who know what to do during a traffic accident |

Highlights

- Relatively high personal accident cover ($50,000) for a no-frills plan

- Offers optional Sun/Moon Roof Cover (up to $2,000) which allows you to claim for repairs and NOT affect your NCD

- One of the youngest limit for young & inexperienced driver excess (24 years old), but really high excess charged ($4,000)

Our Recommendations

- Ideal for the budget-conscious, as they always have Etiqa car insurance promos like Early Saver Promotion (30%) and Thank Etiqa It’s Friday Sale (25%)

- Etiqa’s coverage might seem a little scant especially if you’ve bought a new car, or if you expect a higher level of service

- Great for seasoned drivers who know how to handle a traffic accident on their own

FWD Car Insurance

FWD has 3 comprehensive car insurance plans to choose from.

| Classic | Executive | Prestige | |

|---|---|---|---|

| Workshop | Authorised | Authorised | Authorised |

| Replacement Car | Yes (cars up to 1 year old) | Yes (cars up to 1 year old) | Yes (cars up to 1 years old) |

| Young Driver (<27 years old) Excess | $2,500 | $2,500 | $2,500 |

| Perks | Transport allowance | Transport allowance Use of courtesy car for 3 months |

Transport allowance Use of courtesy car for 3 months |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

Families | Families with young children |

Highlights

- Automatic eligibility for Lifetime NCD Guarantee as long as you achieve 50% NCD and continue to renew with FWD

- Repairs at FWD authorised workshops have extended workmanship guarantee until your car turns 10

- One-time payment for children if both parents die or are permanently disabled in a car accident

- Classic: $250,000

- Executive: $375,000

- Prestige: $500,000

Our Recommendations

- The FWD Classic is good value for drivers older than 27 years old as premiums drop about 20%, can avoid the $2,500 Young Driver Excess as well

- FWD plans, in general, are great for families due to their focus on personal accident coverage

HL Assurance Car Insurance

| Car Protect360 | |

|---|---|

| Workshop | Any |

| Replacement Car | – |

| Excess Waiver | Own damage excess halved for repairs at HL authorised workshops |

| Perks | Transport allowance |

| Best For | New premium cars Seasoned drivers >27 years old |

Highlights

- Freedom to choose your own workshop but if you choose to visit an HL Assurance authorised workshop, you get the assurance that genuine manufacturers’ parts are used and it comes with a 9 months repair warranty

- Own Damage Excess is halved when you choose to repair your vehicle at any of the HL Assurance approved workshops

Our Recommendations

- Best for seasoned and safe drivers who have a few years of driving experience and a high NCD:

- Due high young & inexperienced driver (<27 years old, <2 years driving experience) excess ($,3000)

- A high NCD will help offset the premiums which are on the slightly higher side

- Not much flexibility in customisation less an NCD protector

MSIG Car Insurance

MSIG offers auto insurance plans under 2 names: MotorMax and UMax. Together, they have a total of 4 plans to choose from.

| MotorMax | MotorMax Plus | UMax | UMax Plus | |

|---|---|---|---|---|

| Workshop | Authorised | Any | Authorised | Any |

| Replacement Car | – | Yes (cars up to 1 year old) | – | Yes (cars up to 1 years old) |

| Young & Inexperienced Driver (<27 years old or license <2 years old) Excess | $3,000 | $3,000 | $3,000 | $3,000 |

| Perks | – | Transport allowance Loan Protection Benefit |

– | Transport allowance |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

New cars under warranty | Safe drivers | New cars under warranty Safe drivers |

Highlights

- MotorMax Plus offers a Loan Protection Benefit that pays your outstanding car loan (up to $100,000) in event of accidental death

- UMax plans have a Usage Based Private Motor scheme that rewards safe drivers with a waiver of excess and premium savings

Our Recommendations

- Highly beneficial for safe drivers

- Take advantage of the UMax Usage Based Private Motor scheme to effectively waive the compulsory $3,000 excess if a young and inexperienced driver gets behind the wheel and ends up in a longkang – provided YOU have been driving safely for the past 30 days

NTUC Income Car Insurance

NTUC Income has three comprehensive plans to choose from, one of which is specifically for Porsche owners.

| Drivo Classic | Drivo Premium | Drivo Prestige | |

|---|---|---|---|

| Workshop | Authorised | Any | Any |

| Replacement Car | – | – | – |

| Excess Waiver | Not applicable | Can purchase cover to waive standard excess of $600 | Can purchase cover to waive standard excess of $600 |

| Perks | – | – | – |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

New cars under warranty | If you drive a Porsche Panamera, Cayenne, Cayman, Boxster, 911 |

Highlights

- Orange Force: a first-aid trained Orange Force rider will arrive within 20 minutes to provide advice, take photos, record your statement, ensure your safety, assist in removing your vehicle (if necessary), arrange for alternative transportation or medical attention.

- Enjoy up to 35% discount if you clock less than 9,000km a year under the NTUC FlexiMileage scheme

- Get up to 25% discount on your Drivo premiums by participating in the NTUC Drive Master program

Our Recommendations

- Opt for Drivo Classic if you have an older car and don’t mind going to NTUC Income authorised workshops

- Choose Drivo Premium if you have a new car under warranty and don’t see your dealer’s workshop in the list of authorised workshops

- Highly beneficial for safe drivers or drivers who aren’t heavy road users. Note: You can only pick either the FlexiMileage or Drive Master scheme. Any discount gotten can be stacked on existing NCD or NTUC loyalty discounts.

- A great choice if you don’t mind paying a bit more for peace of mind during traffic accidents or situations

Sompo Car Insurance

A Japanese insurer that offers comprehensive car insurance plans with attractive features.

| ExcelDrive Focus | ExcelDrive Gold | ExcelDrive Prestige | |

|---|---|---|---|

| Workshop | Authorised | Any | Any |

| Replacement Car | – | – | – |

| Excess Waiver | Limited to 50% or $600 | Full (up to $1,000) | Full (up to $1,000) |

| Perks | – | Transport allowance Free NCD Protector |

Transport allowance Free NCD Protector |

| Best For | Older cars (no more warranty) Second hand cars Parallel imports |

Same as Focus | New cars under warranty |

Highlights

- 24-hour Emergency Mobile Accident Response Service (MARS): an officer will arrive within 20 minutes to provide advice, take photos, complete accident statements, and perform E-filing of claims. They’ll even recommend the nearest authorised workshop and arrange for towing.

- Free NCD Protector if your NCD is 30% and above – not applicable for ExcelDrive Focus

- Relatively high transport allowance at $100 for 10 days as compared to a more typical $50 for 5 days – not applicable for ExcelDrive Focus

- Full excess waiver on first claim ONLY if done at an authorised workshop – only 50% and capped at $600 for ExcelDrive Focus

Our Recommendations

- Not really for the price-conscious

- If you’re going for the ExcelDrive Focus, consider upping your budget for the ExcelDrive Gold to take advantage of the abovementioned highlights

- A great choice if you don’t mind paying a bit more for peace of mind during traffic accidents or situations